Difference between revisions of "Importing market data into Excel"

| Line 32: | Line 32: | ||

=== Understanding imported data === | === Understanding imported data === | ||

| − | We have at column A of the spreadsheet the "API Version" and at the column B we have the "Method", both columns can be ignored. At column C we have the "typeid", at D "buy volume", that represents the total volume of buy orders at the broker, at column E "buy average price", that means that if you want to supply all market demand for the typeid you will receive at the end of the transactions ISK equivalent to column D multiplied by column E, column F is the "maximum price offer of the buy orders", column G is the "minimun price offer of the buy orders", column H is the "standard deviation of buy orders", that is a measure of dispertion of the data around the buy average price, column I is the "median buy prices", that means if you want to supply 50% of the demand selling for the best buy orders you will receive payments between the median and maximun price offer of the buy orders per unit of item sold. At column J we have "percentile of buy orders", this percentile reffers to 95th percentile, that means that if you want to supply 5% of market demand you will receive payments between percentile of buy orders and maximum buy orders prices, in our example we can see at | + | We have at column A of the spreadsheet the "API Version" and at the column B we have the "Method", both columns can be ignored. At column C we have the "typeid", at D "buy volume", that represents the total volume of buy orders at the broker, at column E "buy average price", that means that if you want to supply all market demand for the typeid you will receive at the end of the transactions ISK equivalent to column D multiplied by column E, column F is the "maximum price offer of the buy orders", column G is the "minimun price offer of the buy orders", column H is the "standard deviation of buy orders", that is a measure of dispertion of the data around the buy average price, column I is the "median buy prices", that means if you want to supply 50% of the demand selling for the best buy orders you will receive payments between the median and maximun price offer of the buy orders per unit of item sold. At column J we have "percentile of buy orders", this percentile reffers to 95th percentile, that means that if you want to supply 5% of market demand you will receive payments between percentile of buy orders and maximum buy orders prices, in our example we can see at Image 2, that the 95th percentile is the same value of maximum buy orders prices. To understande percentile better I suggest to read [https://en.wikipedia.org/wiki/Percentile Percentile] |

Columns K to Q are information about sell orders, respectively: Volume, average, | Columns K to Q are information about sell orders, respectively: Volume, average, | ||

Revision as of 23:02, 1 October 2016

This article or section is in the process of an expansion or major restructuring. You are welcome to assist in its construction by editing it as well.

If this article or section has not been edited in several days, please remove this template.

Introduction

In EVE Online we have lot of third part software that helps players to plan their activities (always reseach a lot before installing third part software), but what to do if you can't find information you want? Here I will teach unistas how to import market data from eve-central to Excel 2007, in this way you can use creativity to process data and create the information you want in a spreadsheet.

What you will need?

To start you will need to have some data. These data and how to get them are listed below:

- You will need to know the typeid of the item you are looking for. To get the typeid you can use FuzzworkAPI. In this example we will import data from "Iron Charge S" (to use space in this method type "%20", so Iron Charge S = Iron%20Charge%20S), so type the following URL at your browser: https://www.fuzzwork.co.uk/api/typeid.php?typename=Iron%20Charge%20S . We will get the following answer {"typeID": 215,"typeName": "Iron Charge S"}, so Iron Charge S typeid is 215;

- You will need to know the folowing data: stationID or systemID or regionID, you can find this alphabetical ordered at this Spreadsheet ;

- You will need Excel 2007 [:-P]

So, let's start work!

Importing data

As said before, we will import the price of "Iron Charge S", this itemID is 215. We will do this to a system (Jita, systemID = 30000142) and to a region (The Forge, regionID = 10000002).

To do this to Jita system we will use the URL http://api.eve-central.com/api/marketstat?typeid=215&usesystem=30000142 , if you want to do this to a diferent item or a diferent system you can change the number at "typeid=215" with a different typeid or change the number at "usesystem=30000142" with a diferent systemid.

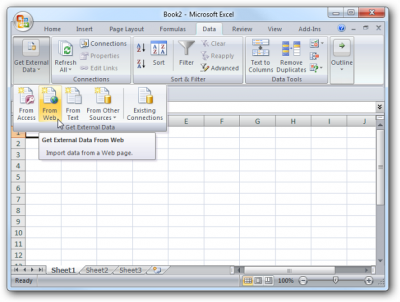

We need to open Excel 2007, go to "Data > Get External Data > From Web", see "Image 1" below:

After that, a browser will pop-up at your spreadsheet, type our URL at the address and click at import. A new window will pop-up asking you where you want to put the data, choose "Existing worksheet" and type "$A$2" and click import again.

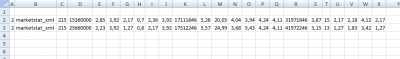

To do this to The Forge region we will repeat the process with the link http://api.eve-central.com/api/marketstat?typeid=215®ionlimit=10000002 , so go to "Data > Get External Data > From Web", type the URL, click at import, choose "Existing worksheet" and, now type "$A$3" to import data to cell "A3". The result will be as the image below:

Understanding imported data

We have at column A of the spreadsheet the "API Version" and at the column B we have the "Method", both columns can be ignored. At column C we have the "typeid", at D "buy volume", that represents the total volume of buy orders at the broker, at column E "buy average price", that means that if you want to supply all market demand for the typeid you will receive at the end of the transactions ISK equivalent to column D multiplied by column E, column F is the "maximum price offer of the buy orders", column G is the "minimun price offer of the buy orders", column H is the "standard deviation of buy orders", that is a measure of dispertion of the data around the buy average price, column I is the "median buy prices", that means if you want to supply 50% of the demand selling for the best buy orders you will receive payments between the median and maximun price offer of the buy orders per unit of item sold. At column J we have "percentile of buy orders", this percentile reffers to 95th percentile, that means that if you want to supply 5% of market demand you will receive payments between percentile of buy orders and maximum buy orders prices, in our example we can see at Image 2, that the 95th percentile is the same value of maximum buy orders prices. To understande percentile better I suggest to read Percentile

Columns K to Q are information about sell orders, respectively: Volume, average, maximum, minimum, standard deviation, median, percentile. In the case of sell orders we are talking about 5th percentile, so that means if you want to buy all 5% of the offers at the broker you will pay prices between percentile value and minimum value.

Columns R to X are information about the last 24 hours opperations in market, so it is historical data, they are important to preview future negociations. They are respectivelly: Volume, average, maximum, minimum, standard deviation, median, percentile.

Importing multiple data

As soon as possible I will continue this article. If you have any doubt you can send an in game message to Victor Corlleone ;-]